Enhance Security With 3D Secure on iPOSpays

3D Secure (3DS) is a global security standard designed to add an extra layer of protection to online card transactions. By requiring additional authentication, 3DS significantly reduces the risk of fraudulent activity. We’ve integrated this advanced security feature into Send Payment Link, Hosted Payment Page (HPP), and the Generic Hosted Payment Page (GHPP), ensuring the highest standards of payment security and providing customers with a safer online transaction experience.

Feature Compatibility

-

Minimum required POS build - 10118 and above

-

Supported Processors:

-

TSYS

-

Fiserv North

-

Fiserv Omaha

-

Elavon

-

-

Supported Fee Types: Supported by all fee types

-

Supported Checkout Flows:

-

Send Payment Link

-

Hosted Payment Page API

-

Generic Hosted Payment Page

-

Prerequisites

To enable 3DS for all necessary card brands (Visa, Mastercard, American Express, etc.), the following information is required from your sponsor bank(s).

If details for a specific brand are not submitted, 3DS will not be activated for that brand.

ISO Onboarding for 3D Secure (3DS)

To enable 3D Secure (3DS) for merchants, the ISO must first be onboarded with CardinalCommerce through iPOSpays. This is a one-time setup per sponsor bank.

✅ Information to Send to Your Dejavoo Representative:

- Sponsor Bank Details

-

Provide the full Sponsor Bank Name

-

This name will be used to register the sponsor in iPOSpays

-

If you plan to onboard multiple sponsor banks in the future, each must be submitted separately with a unique name so they appear as selectable options in the iPOSpays portal

- Acquirer BINs

The Acquirer BIN is a 6-digit number assigned by each card network to identify the acquiring bank or processor. You must submit the Acquirer BINs associated with the sponsor bank for:

| Card Brand | BIN Format |

|---|---|

| Visa | Begins with 4xxxxx |

| Mastercard | Begins with 5xxxxx or 2xxxxx |

| American Express | Begins with 3xxxxx |

| Discover | Begins with 6xxxxx |

-

If you’re unsure of the BINs, contact your acquiring bank or processor.

-

Initial Merchant Setup (Required by Cardinal Commerce)

Cardinal Commerce requires at least one merchant to be enabled for 3DS during onboarding. You must submit:

-

One active MID per card brand (Visa, Mastercard, Amex, Discover)

-

The merchant’s TPN (Terminal Profile Number) on iPOSpays for 3DS activation

⏳ Processing Time:

Once your Dejavoo Representative submits all the required details, the onboarding is typically completed within 2–3 business days.

After onboarding:

-

The sponsor bank will appear in the iPOSpays portal under the name you provided

-

The ISO will be able to enable 3DS for any merchant using that sponsor bank configuration.

How to Enable:

-

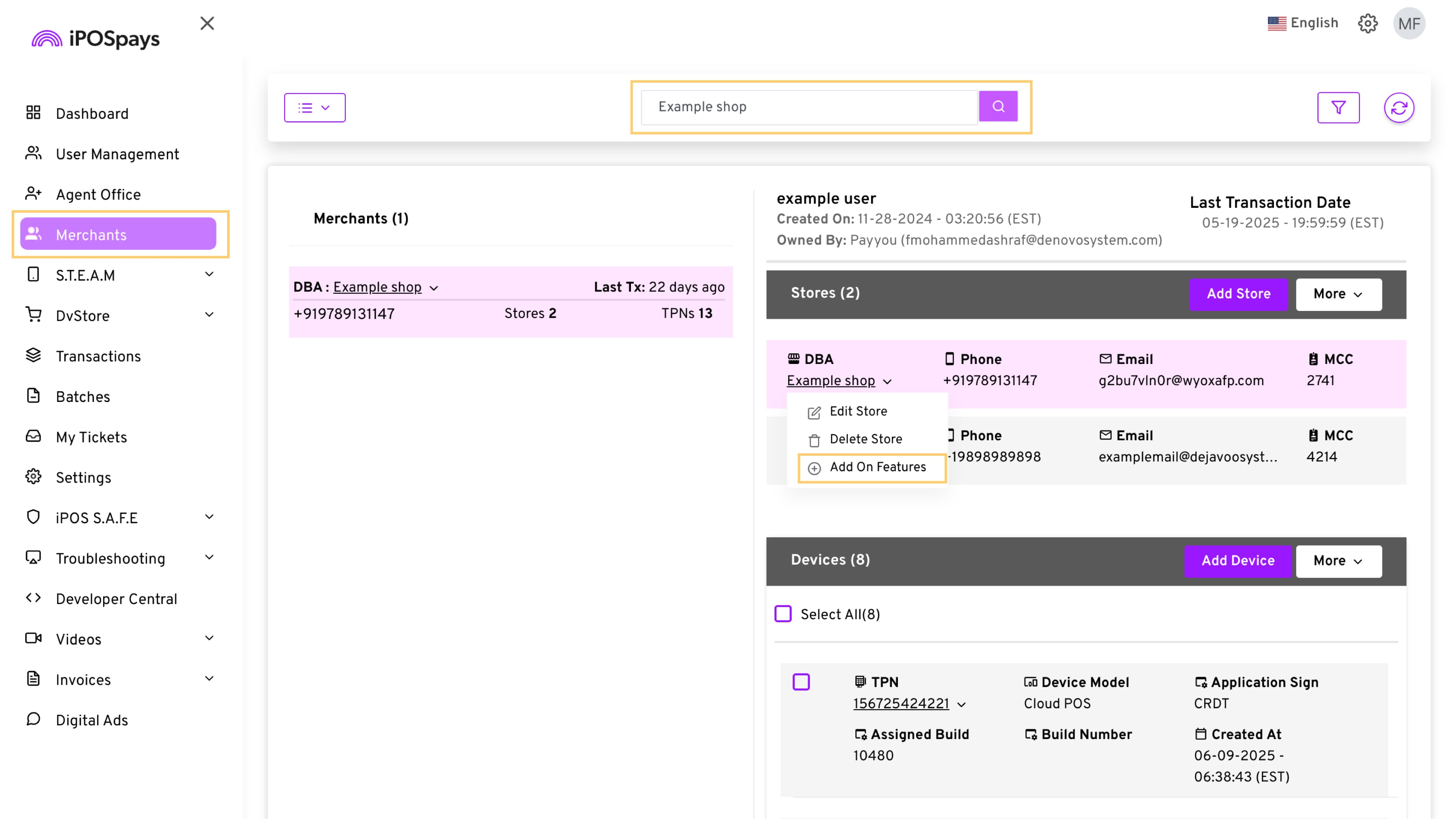

Log in to the iPOSpays portal using your ISO account credentials.

-

Navigate to the Merchants module and use the search box to find the merchant you want to update.

-

Select the merchant, then choose the desired store. Click on the store’s DBA name to reveal the drop-down menu and choose Add On Features.

- Inside the Add On Features section, toggle the 3D Secure button to enable it for the chosen store.

If you see a message indicating you don’t have access to enable 3D Secure, please contact your Dejavoo representative to request the necessary permissions.

-

If there’s only one sponsor bank configured for you, it will be selected automatically in the Sponsored 1 drop-down button.

-

If there are two sponsor banks, you will be able to choose from the Sponsored 1 drop-down button.

-

Your sponsor bank BINs are displayed here by default for reference on all stores.

-

You can then enter the merchant’s ID for Visa, Amex, Mastercard, and Discover. Note that if any of these IDs, such as Visa, is not provided, transactions made with that card type will not be protected by 3D Secure.

-

Click Save for the changes to take effect.

How does 3D Secure work on iPOSpays?

- Transaction Initiation: When a customer enters their card details on our secure hosted payment page (HPP) or generic hosted payment page (GHPP), their browser sends a request to our servers.

Watch this video for a quick demonstration of how 3D Secure works during a transaction.

-

Authentication Request: Our system forwards this request to their card issuer, who determines if 3DS authentication is required based on specific factors.

-

Cardholder Verification: (if required): If 3DS authentication is necessary, the card issuer will redirect the customer to their secure authentication page. The customer will be prompted to provide additional authentication details to verify their identity using a one-time password sent to the customer’s phone number.

-

Transaction Completion: Once their identity is verified by the card issuer, the transaction is completed securely.

Benefits of 3D Secure on iPOSpays

The implementation of 3DS will provide several benefits to ISOs and their merchants:

- Enhanced Security: Protects customer’s sensitive card information from unauthorized access.

- Reduce Fraudulent Transactions: 3DS adds an extra layer of verification during online transactions, making it harder for fraudsters to use stolen card information.

- Increase Authorization Rates: By verifying the cardholder’s identity, 3DS can help reduce the number of declined transactions due to suspicion of fraud.

- Improve Compliance: Many card networks mandate 3DS compliance for card-not-present transactions. Implementing 3DS ensures adherence to these regulations.

- Reduced Chargebacks: Fraudulent transactions often lead to chargebacks, which incur fees for merchants. Implementing 3DS can significantly reduce these costs.

- Improved Customer Confidence: Increased security fosters trust among customers, leading to a better overall shopping experience.